Contents

What is passive income?

Active income is that which is earned by putting in time and effort. For example, if you are an employee then your salary is your active income. If you are a self-employed business owner then the business revenues fall under this category. This type of income is fully dependent on your time. If you stop working this income will also stop coming. In other words, you have to keep on working to maintain this income.

On the other hand, passive income does not need your physical presence or any time/effort from your end. That’s why it is called passive. You will earn money even when you are sleeping.

Why is passive income important?

Over-dependence on active income is risky. As I mentioned above, it is directly proportional to your time and effort. That means as long as your job is there or your business is doing well, you will be earning a regular income. But due to some unfortunate events if you lose your job or your business shuts down then you will be in a soup.

Rich people always focus on building their passive income portfolio. They have multiple sources of income other than their job or business. According to Robert Kiyosaki’s book “Rich Dad Poor Dad”, everyone is running in a rat race. The only way to escape this rat race is to make your passive income grow and become equal to your expenses. At this stage, even if you quit your job or your business shuts down then still you will not be worried. The passive income generated from your folio will take care of your monthly expenses. Now that’s true financial independence.

Best passive income ideas in India

Now that you know what passive income is and its importance, let us look at the different ways how passive income can be generated in India:

Dividend income from stocks

There are multiple stocks listed on the NSE and the BSE that provide regular dividends to shareholders. These are fundamentally strong companies that have bright future prospects. Some examples of such stocks are TCS, Infosys, HDFC Bank, Reliance Industries, etc. You can buy such stocks and then enjoy periodic dividends from them without any extra effort.

Dividend income from mutual funds

Mutual funds also allow you to reap dividends from your investments. Almost all mutual fund houses offer a dividend option in their plans. If you invest in a plan through the dividend option then you will receive periodic dividends from the mutual fund.

Capital appreciation from assets

This is one of the best forms of passive income and my personal favorite. This makes use of the power of compounding to increase the value of your investments. Assets can be of various forms like mutual funds, stocks, real estate, gold, etc. Let’s say that you invested Rs. 1 lac in the stock market. And it grows at an annual rate of 12%. Obviously, this rate will not be the same across all the years. On some years this will be as high as 20% or more and on some, it can go lower than 10% or even negative. But over a term of 10+ years, the stock market has on an average given return in excess of 12%. So, assuming a 12% return, the 1 lac invested would grow to Rs.3,10,585 at the end of 10 years. That’s a return of Rs. 2,10,585 on an investment of just Rs.1 lac!! The return is more than double the investment and that too without putting in any effort or time. That’s the magic of compounding.

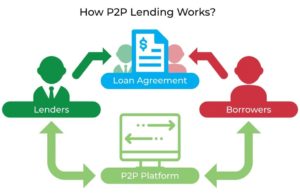

Peer to peer (P2P) lending

This is a new concept that has come to India. But it has already been a great success in countries like the US, China, and UK where it has been there for over 10 years now. To explain it in simple terms, a borrower registers on a P2P platform for his/her loan requirements. The platform evaluates the borrower on a number of parameters and assesses his ability to repay the loan. Finally, if he clears the selection then his loan will be made live on the platform and will be shown to investors. Based on the credit score & the credibility of the borrower, loan interest will be levied for the loan. A pool of investors will then chip in with small amounts and fulfill the loan requirements. In return, the borrower will start paying a monthly EMI to each of the investors starting next month. Interest rates can be anywhere between 16-25%. In some cases, it can go even higher.

Car rental business

This is a good form of passive income and an opportunity to start a business while working full-time at a job. Here you can purchase a modest car like a Tata Indica or a Swift Dzire. Then you can turn it into a commercial vehicle and attach it to any of the car rental companies like Uber and Ola. You can also hire a driver for the car. Considering the driver’s salary and other expenses like fuel, car maintenance, etc. you can easily earn anywhere between 15,000-20,000 rupees profit per month.

Real estate rental business

This is a good old way of earning passive income. Here you purchase a property namely a residential flat and then give it to tenants for a monthly rent. Purchasing a property requires a large capital investment. You may have to initially invest to accumulate money for 20% down payment of the flat. And for the remaining amount, you can apply for a home loan from the bank.

Recommended reads: PPF, what is it and what are its benefits?

Sell ebooks/online courses

If you have expertise in a particular area and you feel that you can put it in words or a course then this is a very good option for you. It will need an initial investment of time and effort from your end. You will have to meticulously plan the chapters of your book or the outline of your course. Then you will have to be careful while designing the book cover or the course. And spend significant time in marketing it as well. But once you put in that initial effort and people come to know about your product then it becomes fully passive from thereafter. With each book sale, you will earn royalty income. Also, you will be earning a regular income from the sale of your courses.

Build & sell smartphone apps

If you know Java/Kotlin or any of the other Android/iOS programming languages then you can build an app of your own. It does not have to be too complex. It just needs to solve problems for at least some people. Once you have built the app, you can then publish it on Google or iOS play store and market the app. Over time with each purchase of the app or in-app advertising (if the app is free) you will earn passive money.

Cashbacks from 3rd party apps and cards

There are many banks which offer cashback credit/debit cards like those mentioned in this article. You can make use of those while doing any online transaction to earn some cool cashback. Also, there is an online app called “CashKaro” that offers cashback each time that you make an online purchase through their website. Then there are websites like Swiggy, Zomato, Uber Eats, etc. that have discount codes that can be applied while placing an order. All these are easy and cool ways to earn some passive income.

Interest from fixed/recurring deposits

This is one of the traditional ways of earning passive income. It is also one of the safest with full capital protection. Nearly all banks in India offer the facility of creating a fixed or a recurring deposit. You have to invest a considerable amount as a principal in a fixed deposit for a certain tenure with the bank. And in return, the bank will pay you interest on the invested capital.

Interest from a savings account

This is also a well-known way of generating passive income. But it is not that beneficial or recommendable. That’s why I have kept it as the last item on my list. The reason being the interest rate offered by most banks for savings accounts is too less. It usually ranges from 3-4% whereas inflation itself these days is growing at the rate of 6% per annum. Hence over the long term, your money will depreciate in value if you let it idle in your savings account. Better to invest in higher yield instruments such as mutual funds, stocks, P2P loans or even fixed/recurring deposits.