Contents

Retirement planning is one of the most important financial exercises of a person’s life. Yet this is often the most overlooked and ignored one. As per the latest reports, India’s youth population (15-29 years) is expected to cross 45 crores by 2021 and thus by 2020 India will become the youngest country with 64% of its population in the working-age group (15-64 years).

While this is an encouraging fact and looks promising in many aspects, there is a flipside to it. In a few decades from now, India will have one of the largest elderly population. The United Nations Population Division estimates that the number of people aged 60 and above in India is estimated to grow from 8% of the population in the year 2010 to 19% in the year 2050. This translates to 32.3 crore people who are aged and out of job and hence potentially income-less and exposed to financial exigencies.

While the above facts are disconcerting, what is shocking to know is the level of preparedness of Indians in terms of retirement planning. According to a Max Life and Nielsen study, despite 60% of Indians not having any retirement plan, 63% feel that they will have sufficient money during their retired years. It is difficult to make out where that misplaced confidence comes from when over 40% of Indians are oblivious of the amount of money they would require for their retirement needs. All these should be seen in the context of a country where social security is grossly inadequate and where the joint family system has given way to nuclear families. Further, health costs are rising where hospitalization expenses have increased by 176% between 2004 and 2014.

Hence it is a necessity for people to make their own arrangements for their retirement years. There are several benefits of starting early when it comes to retirement planning as can be seen below.

Benefits of starting retirement planning early

More time for money to grow (Power of compounding)

Einstein once said that compounding is the 8th wonder of the world. Well, it truly is. Let’s say that Ram started with a modest monthly investment of Rs.2000 per month in an equity fund from the age of 22. Let’s say that he is planning to retire by 55. So, his money is getting 33 years to grow. Considering a 12% rate of return for equity funds and 6% rate of inflation, his total investment at the end of 33 years will be Rs. 7,92,000. And guess what the total matured amount will be?

A whopping 1,01,87,996 rupees!!

That’s a return of 93,95,996 rupees on investment of 7,92,000 rupees. That’s the power of compounding. The more time your money gets to grow the bigger it gets. Now, don’t you feel that you should take advantage of it to build a large corpus to enjoy your retired years?

Some more examples of the magic of compounding follow:

- A monthly investment of Rs.3000 for 33 years would have given Ram a corpus of Rs.1,52,81,994

- A monthly investment of Rs.4000 for 33 years would have given Ram a corpus of Rs.2,03,75,992

- A monthly investment of Rs.5000 for 33 years would have given Ram a corpus of Rs.2,54,69,990

- A monthly investment of Rs.6000 for 33 years would have given Ram a corpus of Rs.3,05,63,989

- A monthly investment of Rs.7000 for 33 years would have given Ram a corpus of Rs.3,56,57,987.

Less monthly contribution required to achieve the same corpus

Let’s say Ram and Rahim (both aged 22), get a new job in Mumbai. Rahim wants to enjoy his life and so he decides to spend on parties, buying expensive gadgets, drinks, eating out at expensive restaurants, etc. He feels that he is too young to think of retirement planning as yet.

Ram, on the other hand, is concerned about looking at Rahim’s lavish spending habits. He tries to caution Rahim but he does not pay any heed. Ram plans in his mind that he is going to retire by the age of 55 and he would need a corpus of 1 crore rupees by that time to spend the rest of his retired life peacefully. So that means that he has to invest a monthly sum of Rs. 2000 to achieve his required corpus by the time he turns 55.

Rahim, on the other hand, continues with his extravagant lifestyle for the next 15 years without any concern for retirement planning. Then at the age of 37, he realizes that he needs to plan for his retirement at 55 and calculates the monthly contribution required to achieve the same. Guess what he finds out?

He now needs to make a monthly investment of Rs.14000 if he wants to build the same retirement corpus of 1 crore rupees. Whereas, Ram, on the other hand, can happily continue with his Rs.2000 monthly SIPs. The delay of 15 years has increased his required monthly contributions by 7 times!! A costly mistake to say the least.

Below are some more examples of how a delay of some years can shrink the retirement corpus considerably:

- A monthly investment of Rs.2000 delayed by 15 years can reduce the corpus by Rs.86,57,118

- A monthly investment of Rs.3000 delayed by 15 years can reduce the corpus by Rs.1,29,85,676

- A monthly investment of Rs.4000 delayed by 15 years can reduce the corpus by Rs.1,73,14,235

- A monthly investment of Rs.5000 delayed by 15 years can reduce the corpus by Rs.2,16,42,794

- A monthly investment of Rs.6000 delayed by 15 years can reduce the corpus by Rs.2,59,71,354.

More options to choose from in retirement planning

One of the major advantages of starting retirement planning early is the large choice of products that one can choose from. There are a plethora of retirement products available in the market ranging from PPF, ULIPs, FDs, pension plans to ELSS, equity funds, debt funds, etc. The choice of product should depend on the age and the risk appetite of the individual.

For example, if someone is in their 20s they have more capacity to take risks as compared to someone who is in their 40s. Even if the former loses money in the market, he/she has more time to bounce back and recover the losses. On the other hand, a middle-aged person does not have that luxury. With retirement knocking on the door in a few years, he has to be careful that he does not blow up his life’s saving by taking unnecessary risks.

Based on the risk appetite, a young person can hence choose to either invest in equity products like ELSS or in relatively safer ones like PPF, FDs, etc. There will be volatility in equity investments over the short term. But if is one is willing to stay invested for the long term then he will be richly rewarded for his patience. Historically, ELSS has offered much better returns as compared to other conventional products like PPF, EPF, etc. over the long term.

Read now: ELSS or PPF: Which is a better tax saving investment option?

But a person who is nearing retirement cannot afford to invest in equity funds. He has to take the safer route of PPFs, FDs to build his retirement corpus. Although that might mean sacrificing the returns on his investment. Time is not your friend when you start late on retirement planning. Hence, start early and see your investments grow with time. Make hay while the sun till shines.

Less financial responsibilities, more money to invest for retirement

Retirement planning should start at a time when there are not a lot of financial burdens on your shoulders. When Ram is 22 years old, he has just graduated from college and joined a new job. He has fewer financial responsibilities. He is not yet married so he does not have any dependents to support. Whatever expenses are there for household and shopping, mostly he is the only consumer for those. This is the ideal time for him to start his retirement planning.

He should start by drawing up a budget for his monthly expenses. In that budget, he should define categories for each of his expenses and set a maximum limit for each of those. He should take care that in no way he exceeds those limits. For this purpose, he can use a budgeting app available in the Google play store or Apple store. They have some pretty good budgeting apps there.

Once the expense budget is set up, he should then plan for investing the remaining amount of money into proper channels. The investments should be such that he can easily reach his financial goals. He should calculate the amount of retirement corpus that he will need to happily spend the rest of his life. Based on that, he should start his investments into appropriate products.

Save taxes

Under Section 80C, the Government of India allows a maximum rebate of Rs.1,50,000 on the taxable salary of an individual. There are multiple products that qualify for this section:

- ELSS mutual funds

- Public Provident Fund (PPF)

- Employee Provident Fund (EPF)

- National Pension System (NPS)

- National Savings Certificate (NSC)

- Unit Linked Insurance Plans (ULIP)

- Tax saving fixed deposits

- LIC investments

- Repayment of home loan.

There are many others present in the above list. Out of all these, ELSS mutual funds and PPF/EPF offer dual benefits to investors. On one hand, they allow him to build his retirement corpus. And on the other, they also to save taxes on his salary.

Let’s say that Ram falls in the highest tax bracket and he has to pay 30% tax on his income. Now if he invests an annual sum of Rs.1,50,000 in ELSS funds then he becomes eligible for a tax deduction. Hence, by investing in ELSS funds he is able to save 30% of Rs.1,50,000 = Rs.45,000 on his taxes for that financial year. Plus, he is getting the added benefit of creating his retirement corpus.

If Ram invests the saved 3750 rupees (45000 rupees/12) per month in an equity fund every year for the next 33 years, then he will get a total of Rs.1,91,02,493.

That’s a return of Rs.1,76,17,493 on an investment of only Rs.14,85,000!!! That’s simply mind-blowing.

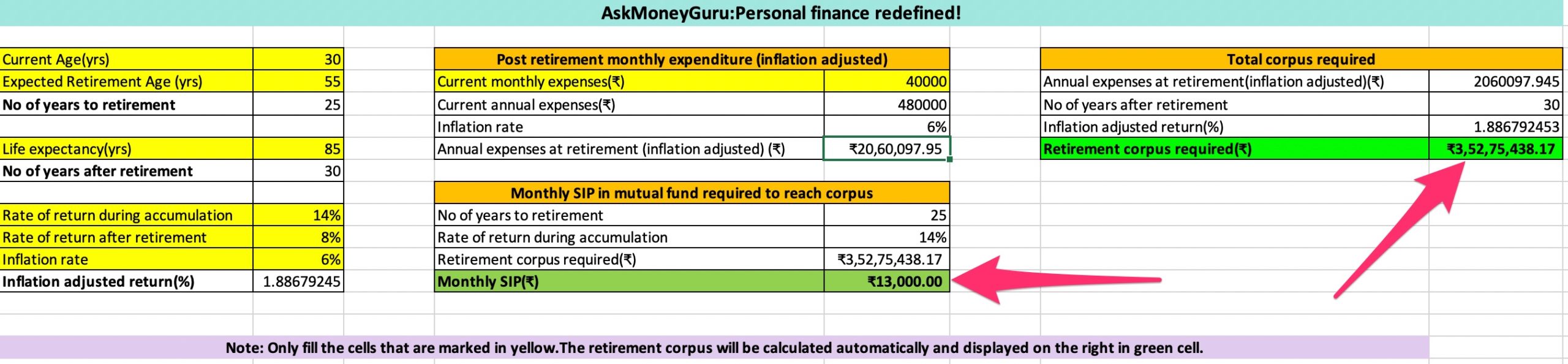

How to calculate the required retirement corpus?

This is one of the most common question asked by people who are starting on their retirement planning journey. This is also the question which most investors are unable to answer no matter how experienced they are. There are a lot of factors involved. It varies from one person to another depending on their present age, retirement age, monthly expenses, etc.

Below are the factors that need to be considered while calculating the retirement corpus for any person:

Current Age

Depending on the present age, the investment horizon will be calculated. For instance, if a person is 22 years old and he plans to retire at the age of 55 years then he will have a time period of total 33 years to invest. Based on that, his monthly contribution can be determined to accumulate the desired corpus.

Retirement Age

As mentioned above, this is needed to calculate the investment period and the monthly contribution required.

Life Expectancy

This is the period after retirement that a person is expected to live. This is important because the retirement corpus needs to sustain for all those years. For example, if a person retires at 60 and he lives till 85 years then his retirement corpus should be such that it can easily manage his expenses for this duration.

Monthly Expenses

The current monthly expenses need to be considered while doing retirement planning. This is the minimum amount that will be required post-retirement every month to sustain the same standard of living.

Annual Rate Of Interest

This is important because based on it we will be able to determine the monthly contribution required to reach our retirement goal. On average, equity funds offer a 12% rate of return while PPF/FDs offer anything between 5-7% per annum.

Inflation Rate

This is a very critical factor which many people forget to consider during retirement planning. The value of Rs.1000 today will not remain the same after 30 years. Due to inflation, the value will drop considerably. A car which costs Rs.5 lakhs today will cost around Rs.29 lakhs after 30 years. Hence it is imperative that we keep this in mind while calculating our retirement corpus. If we forget to consider this then we will fall way short of our retirement goal. And the money accumulated will not be able to sustain our lifestyle for the remaining years of our lives.

How to use the corpus to happily spend the retired life?

Now that Ram has done all the hard work and finally created his retirement corpus, it’s time to put it into use, For this purpose, he can start a Systematic Withdrawal Plan (SWP) in a debt mutual fund. Under this scheme, he will be investing his full retirement corpus in a debt fund. And every month on a pre-determined date, he will be able to withdraw a fixed amount from it. This money he can then use to take care of his expenses for that month. While this money is being used for monthly expenses, the remaining money stays invested and earns interest depending on the prevailing interest rates. So, his corpus keeps on growing while he is also able to take care of his monthly expenses.

If properly planned in advance, old age doesn’t need to be a time of frugality or dependence. Instead, it can be a time of freedom, happiness, and financial independence.

Payment link: Click here.